We pride to be the best Sub-Saharan data collection experts and the best data analytics hub. Therefore, don’t look elsewhere or hustle any more for these services, come for the best at Charima Research. Our field briefings do not leave anything for chance; we take project matters very serious and always, right from the background of the project or research need, to the objectives of the study. Our field teams are gurus when it comes to applying the field techniques; we are yet to come across anyone who can beat us in these services.

Below are various methods of data collection that we use on daily bases when carrying out data collection in Africa, for both research methodologies; i.e. quantitative and qualitative research methods i.e.

- Quantitative surveys /studies / experiments that includes:

- Face to face interviews (F2F); quite often nowadays we use Mobile data collection methods for F2F surveys i.e. (CAPI-Computer Assisted Personal Interviews) and also we have a few projects that we use Paper and pen Interviews (PAPI).

- We carry out Household interviews, Central location tests (CLT)- i.e. (Tests for products, packaging, pre/posts adverts) and also we carry out Mall intercepts as well as Street intercepts

- Telephone surveys i.e. Computer aided telephone interviews (CATI)

- Web surveys i.e. (Online surveys)- (CAWI-Computer Aided Telephone Interviews)

- Text messaging surveys

- Qualitative studies/ ethnographies that includes:

- Focus groups discussions (FGD) i.e. physical FGDs and Online FGDs

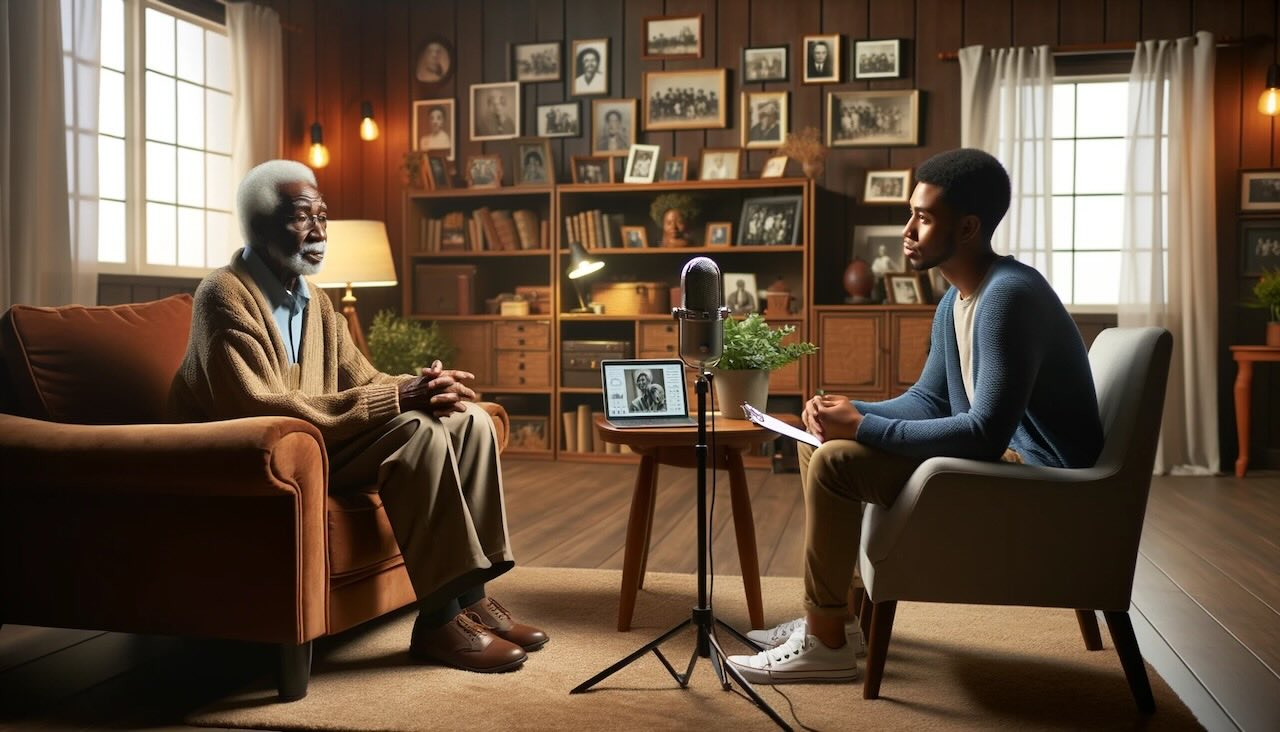

- In-depth interviews (IDIs) i.e. physical IDIs (Key informant interviews(KIIs)) and also Telephone in-depth interviews (TIIs),

Our field interviewers and supervisors bring field reports at the end of data collection, with any useful information that they may encounter during field work process.

Face to Face Interviews

Face-to-face interview is a data collection method when the interviewer directly communicates with the respondent in accordance with the prepared questionnaire. This method enables to acquire factual information, consumer evaluations, attitudes, preferences and other information coming out during the conversation with the respondent. Thus, face-to-face interview method ensures the quality of the obtained data and increases the response rate.

Face-to-face standardised / semi-standardised interview is a quantitative research tool. Therefore, it is applied in national or certain region population inquiries, consumer, and customer or reader surveys. Furthermore, this method is practised when performing Omnibus and Ad Hoc researches.

By far, the main advantage of the face-to-face interview is the presence of the interviewer, which makes it easier for the respondent to either clarify answers or ask for clarification for some of the items on the questionnaire. Face to face interviewing method minimizes nonresponse and maximizes the quality of the data collected.

Household interview surveys

Household interview surveys are a bit more labor intensive and requires proper procedure. At Charima we undertake the surveys with experienced staff for planning purpose and project execution to ensure that accurate and reliable survey data is delivered within pre-determined timelines and budgets.

All household interview surveys are organised in accordance with the procedures and standards detailed in the market research code of conduct, the surveys are always overseen by senior staff. The safety of the interview staff is a prime concern when undertaking surveys of this nature, At Charima we have stringent procedures in place to minimise the risk to interviewers whilst operating on site.

All our interview staff receives a comprehensive briefing to ensure they are both familiar with the survey questions and the reasoning behind them. A comprehensive survey manual is always provided which clearly sets out the purpose of the survey and detailed instructions, including those relating to interpretation, for each question.

Mall Intercepts

It is a method of data collection in which interviewers in a shopping mall stop or intercept a sample of those passing by to ask them if they would be willing to participate in a research study; those who agree are typically taken to an interviewing facility that has been set up in the mall where the interview is conducted

Rather a mall-intercept is a survey whereby respondents are intercepted in shopping in malls. The process involves stopping the shoppers, screening them for appropriateness, and either administering the survey on the spot or inviting them to a research facility located in the mall to complete the interview. While not representative of the population in general, shopping mall customers do constitute a major share of the market for many products. We help you analyse the shoppers with simple yet dynamic questionnaires. Mall intercepts uses a convenience sampling methodology.

FGDs & IDIs Moderations and Transcriptions

Our moderators ensure that the focus groups discussions (FGDs) and in-depth interviews (IDIs) are well controlled and managed. Our moderators are well trained to handle any groups or individuals when we are dealing with qualitative research and ethnography research methodologies. We understand that different respondents and groups of respondents may exhibit different characteristics that require the best respondent/group moderators. We are the team when it comes to FGDs and IDIs look no further.

Charima skilled editors review the transcripts line by line, word for word against the audio to ensure validity of the data. Our transcribers transcribe the audios to the hand copies to ease the work of analysis for our clients.

Professionally formatted transcripts are delivered to clients in MS-word, either via email or electronically. We also deliver well written transcriptions.

CATI

CATI – computer aided telephone interview is one of the methodologies used to collect data for the market and social research. CATI are done from the call centers with interviewers using computers with scripted questionnaires, phoning the respondents to give answers while filling the answers for the respondents into the scripts.

At Charima Research, we have the resources to meet your needs for big and small assignments through CATI methodology. Our CATI team is a highly knowledgeable, experienced and eloquent team of CATI interviewers. When executing our CATI projects, we make some things standard, like using native language speakers for any specific community or country and normal working time zones for various different regions.

Our CATI system has a wide team of interviewers that are well versed with different community languages and culture that is needed to integrate well with the respondents during the interviews. We cut across the markets and industries, whether it is business to consumers B2C or business to business B2B CATI projects we deliver them on the top notch. Our know-how and skills, enables us to execute quick-turnaround assignments and also long-term assignments as well as more engaging international projects. We, at Charima Research reaches out to the highly targeted whether large or small sample sizes including tracker surveys.

In many times, online surveys are very cost effective followed by CATI. For us we care more about providing the best quality outputs in the most economical way. That is why online and CATI methodologies are part our forte amongst other methods of the data collection methods that we use.

Our interviewers are well experienced, knowledgeable and trained to handle different projects and diverse categories of the respondents. Therefore, through our CATI teams, we are able to get factual feedback from the respondents including from the hard ones to talk to.

For all of our telephone in-depth interviews, TDIs, our calls are recorded with clarity and entirety to ensure no information gets lost during the interview. We request for the respondents’ permission to share of their feedback recordings with our clients. The recordings are usually kept safely and with lots of confidentiality.

For our CATI services, we cover many of the countries in Africa, Asia and beyond.

Online Surveys (CAWI)

It is a method of data collection in which interviewers in a shopping mall stop or intercept a sample of those passing by to ask them if they would be willing to participate in a research study; those who agree are typically taken to an interviewing facility that has been set up in the mall where the interview is conducted

Rather a mall-intercept is a survey whereby respondents are intercepted in shopping in malls. The process involves stopping the shoppers, screening them for appropriateness, and either administering the survey on the spot or inviting them to a research facility located in the mall to complete the interview. While not representative of the population in general, shopping mall customers do constitute a major share of the market for many products. We help you analyse the shoppers with simple yet dynamic questionnaires. Mall intercepts uses a convenience sampling methodology.

Retail Census (RC)

Retail census (RC) is conducted to measure the size and characteristics of the universe. These estimates, which are updated on a regular basis, are used to:

- Identify different outlet types and quantify number of outlets in a universe by type.

- Provide key statistics for setting up a representative retail panel.

Details collected in a retail census typically include: outlet name, outlet physical address, outlet telephone number, outlet type e.g. supermarket, duka, hypermarket, convenience store, etc, use of scanning equipment, presence of air-conditioning, refrigeration facilities, number of hours open per day, monthly turnover, floor space, presence of major product categories, products types available, product sizes available, Outlets GPS coordinates, outlet images/photos, etc.

Retail census (RC) is conducted to measure the size and characteristics of the universe. These estimates, which are updated on a regular basis, are used to:

- Identify different outlet types and quantify number of outlets in a universe by type.

- Provide key statistics for setting up a representative retail panel.

Details collected in a retail census typically include: outlet name, outlet physical address, outlet telephone number, outlet type e.g. supermarket, duka, hypermarket, convenience store, etc, use of scanning equipment, presence of air-conditioning, refrigeration facilities, number of hours open per day, monthly turnover, floor space, presence of major product categories, products types available, product sizes available, Outlets GPS coordinates, outlet images/photos, etc.

Our field personnel armed with area maps and questionnaires, go street by street collecting the relevant information. Most of the information is gathered by observation, and the remainder may be obtained from store owners/employees. Using the right data collection methodology like left/right hand rule methodology or any other is key to ensure total and thorough mop up of the outlets in the all the streets without skipping any outlet or street. For thorough mop up purposes, the defined universe is split into a number of mapped areas called primary sampling units (PSU). The PSUs are categorized by some measure of size usually provided by government, e.g. cities, towns, villages or polling districts. Every outlet is surveyed within the sample of which it can either be a country, or a certain region.

Information on monthly turnover for the stores of participating retailers is obtained from their data. As for non-participating retailers, some store owners may refuse to divulge data of this nature. For these stores, the missing data is projected by statisticians based on store characteristics such as store type, location, floor size, number of major categories, facilities etc.

Sometimes the rolling census is used for some geographical areas such as cities. The PSUs are divided across and spread across geographical areas, store types, location types. Once these PSUs are defined, the country or an area is surveyed periodically e.g. once every three months or every six months or every once a year, rolls from one country to another, or from region to another. So that over time all countries or regions are covered, and the cycle continues.

The core purpose of the retail census is to establish a basis for the sample design, and the foundation for the retail tracking service. It does however serve a number of secondary objectives. For example, store census information is used by sales management for developing sales strategies, and the aggregate data provides an understanding of retail trends in regions and countries.

Retail census categories and industries that we cover

- Beverage / Drink products

- Food products and Confectionary products

- Household products

- Dairies

- Personal care products

- Skin care products

- Telecommunications

- Media

- Financial services

- Pharmaceuticals

- Toiletries and cosmetics

- Construction

- Transport

- Energy

- Vehicles

- Tobacco

- Advertising etc.

Charima Retail Census:

For your retail census (RC), reach out to us at Charima Research for further engagement and execution of your retail census projects in Africa.

Retail Audit (RA)

Retail Audit (RA) is a wellness check for your brand in the marketplace. Essentially, a retail audit rather a store audit assesses the health of your retail location using hard data. Retailers or staff combs through your store or pop-up shop to collect information on what’s working and what’s selling and or what is not.

Store Audit mainly takes record of the following items;

The three common types of audits include the following;

- Health and Safety Audits.

- Loss Prevention Audits.

- Merchandising Audits.

The other three main types of audits: i.e. external audits, internal audits, and Internal Revenue Service (IRS) audits. External audits are commonly performed by Certified Public Accounting (CPA) firms and result in an auditor’s opinion which is included in the audit report.

The retail audit is an essential way brands and retailers optimize performance across their businesses. The retail audit captures critical data regarding products, sales, merchandising, compliance, pricing, store conditions, competitive intelligence and many other factors that contribute to retail sales.

Track and measure in-store execution in real time. Complete oversight and collaborative workflow involving the regional manager and the franchisee. This reduces communication overheads and costly back-and-forth.

The following are the qualities of a good auditor that we engage in our retail audits. i.e. they show high integrity, they are effective communicators, they are good with technology, good at building collaborative relationships, always learning, they are analytical, creative, innovative, and team orientated.

The following are the steps taken in the Retail Audit process;

- Determine the main objectives of your retail audit. Articulate your goals.

- Design audit criteria. Select the exact questions you will be asking in the audit and the acceptable answer types.

- Schedule appointments.

- Gather data, photos, and geolocation coordinates.

- Evaluate results.

- Implement changes.

- Repeat the process.

Retail Audit categories and industries that we cover;

- Beverage / Drink products

- Food products and Confectionary products

- Household products

- Dairies

- Personal care products

- Skin care products

- Telecommunications

- Media

- Financial services

- Pharmaceuticals

- Toiletries and cosmetics

- Construction

- Transport

- Energy

- Vehicles

- Tobacco

- Advertising etc.

Charima Retail Audit:

For your retail audits rather store audits, reach out to us at Charima Research for further engagement and execution of your retail audit projects in Africa.